doordash business address for taxes

Your biggest benefit will be the. In order to evaluate if Doordash is worth it after Taxes we need to evaluate the tax calculations and numbers in details.

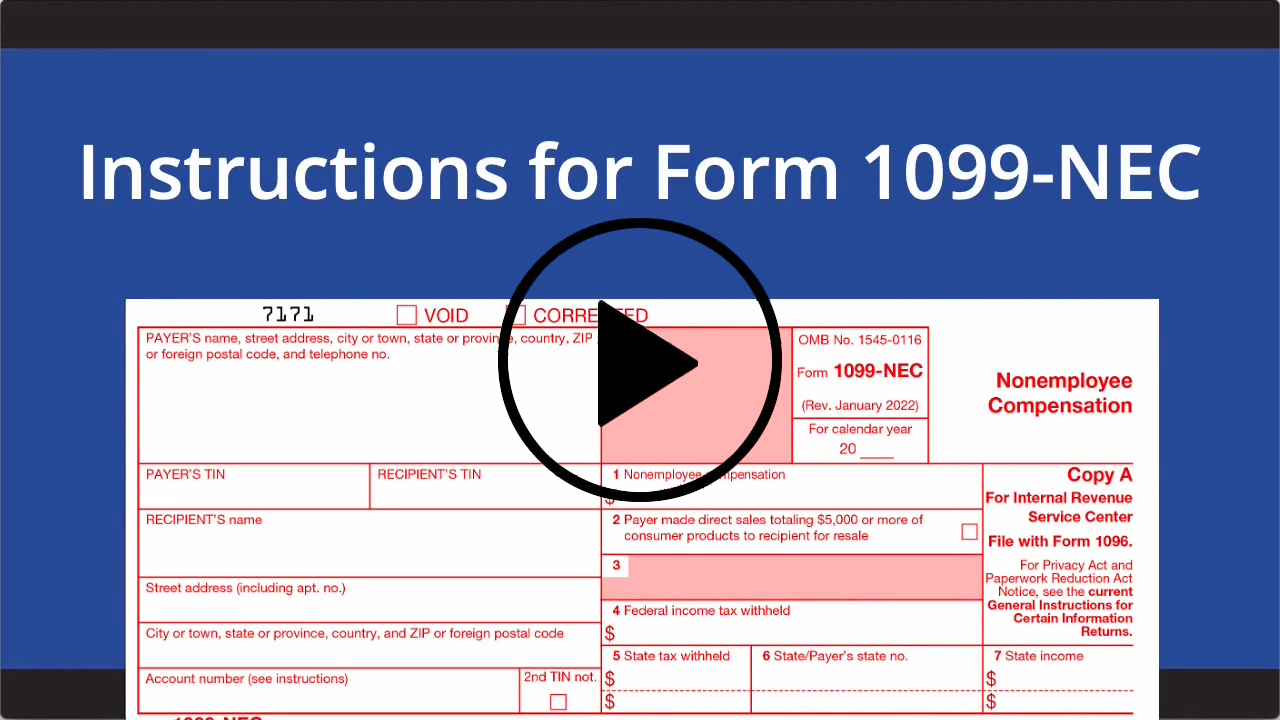

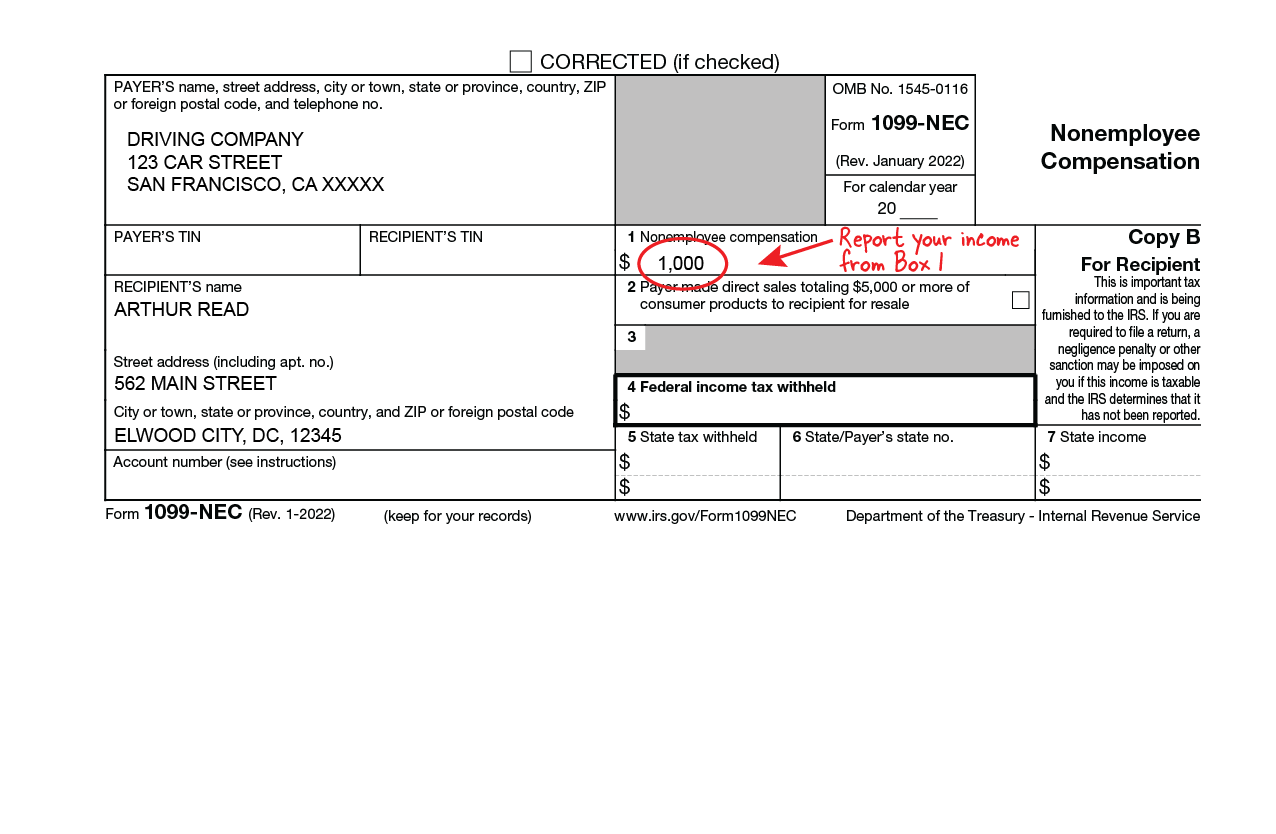

Form 1099 Nec Instructions And Tax Reporting Guide

This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

. Please allow up to 10 business days for mail delivery. This means that DoorDashers will get a 1099-NEC form from DoorDash. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

Ad Talk to a 1-800Accountant Small Business. Income from DoorDash is self-employed income. All you need to do is track your mileage for taxes.

You will pay to the Federal IRS and to the State separate taxes. As a Dasher you are considered a. Increase order volume size.

Please search your inbox for an email titled Action required to receive your DoorDash 2022 tax form. The employer identification number EIN for Doordash Inc. March 18 2021 213 PM.

- All tax documents are mailed on or before January 31 to the business address on file with DoorDash. However you may now be wondering what the process is for filing DoorDash taxes in 2022 to ensure you cover any tax liability. DoorDash will provide its earnings and that earnings will be presented on the 1099-NEC form.

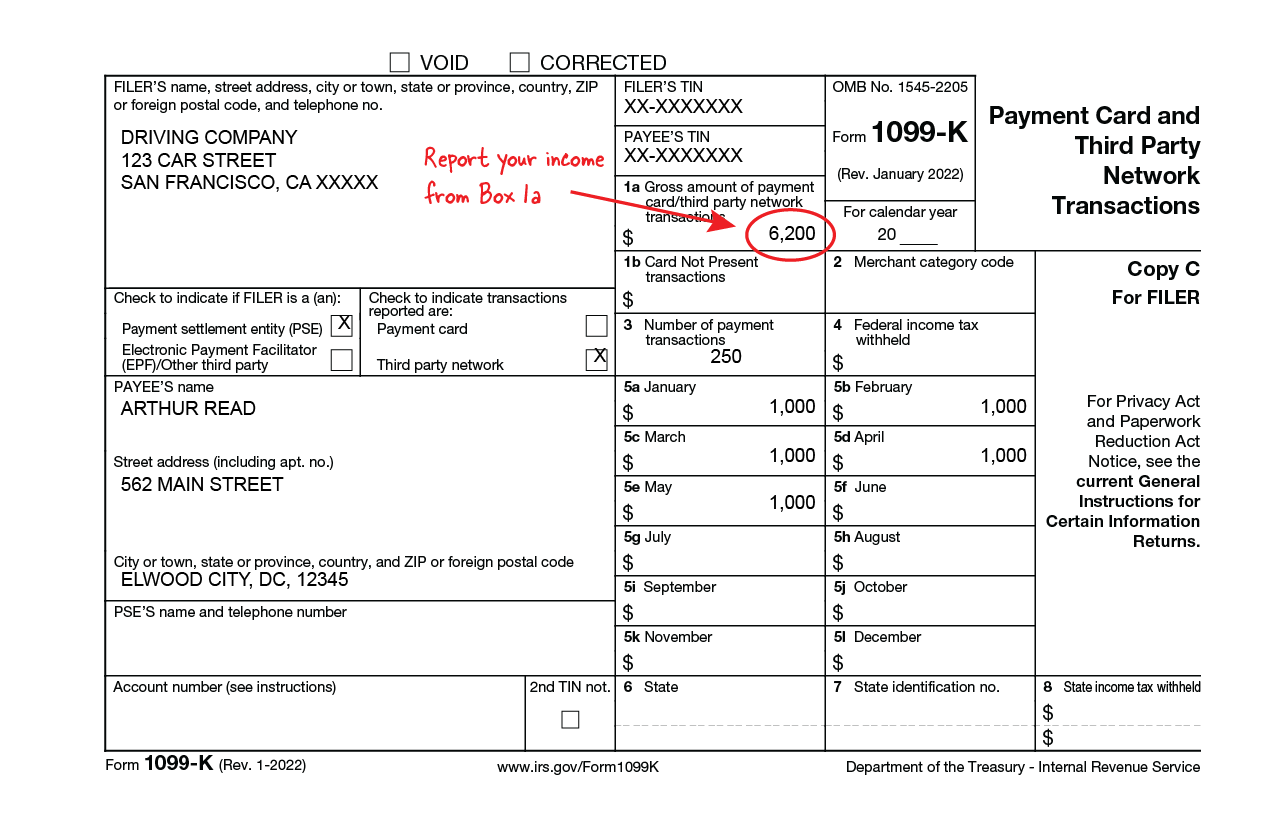

Food delivery is now a 150 billion business but uncertainty and lack of profit continue to loom Credit-card data indicate that third-quarter growth of gross order value. Learn how to file your taxes as a DoorDash driver where to get the tax forms you need and how to maximize your deductions. Uber Eats and others as a full time business is a lot different.

A 1099 form differs from a W-2 which is the standard form issued to. Is a corporation in San Francisco California. Internal Revenue Service IRS and if required state tax departments.

BUSINESS ADDRESS EIN 462852392 An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. All tax documents are mailed on or before January 31 to the business address on file with DoorDash. 1 Best answer.

A 1099-NEC form summarizes Dashers earnings as independent. You are considered as self-employed and in IRS parlance are operating a business. Increase order volume and size and as a result profits with Promotions that provide customers with discounts or free items only when they reach a.

Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate. Choose the expanded view of the. DoorDash will file your 1099 tax.

This means you will be responsible for paying your estimated taxes on your own quarterly. Paper Copy through Mail. The forms are filed with the US.

Why Does This Doordash Tax Calculator Measure Tax Impact. The bottom line is your tax situation is unique. EIN for organizations is sometimes also referred to as.

Keep your restaurant taxes organized. Lets assume you work for Doordash for 40 Hours a week. Since DoorDash earnings are treated essentially the same.

Doordash Tax Guide What Deductions Can Drivers Take Picnic Tax

A Complete Study Of Doordash Business Model Revenue

Restaurant Owners How To Become A Doordash Partner Merchant

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/6AALXOJALFB2TPZXMLQRWINV5I.jpg)

Doordash Postmates Didn T Collect Pa Sales Tax As They Should

Forgot To Track Your Miles We Ve Got You Covered 2020 Taxes

Doordash Pushes Back Against Fee Delivery Commissions With New Charges

Ghost Kitchens Haunted By Unresolved State Tax Questions

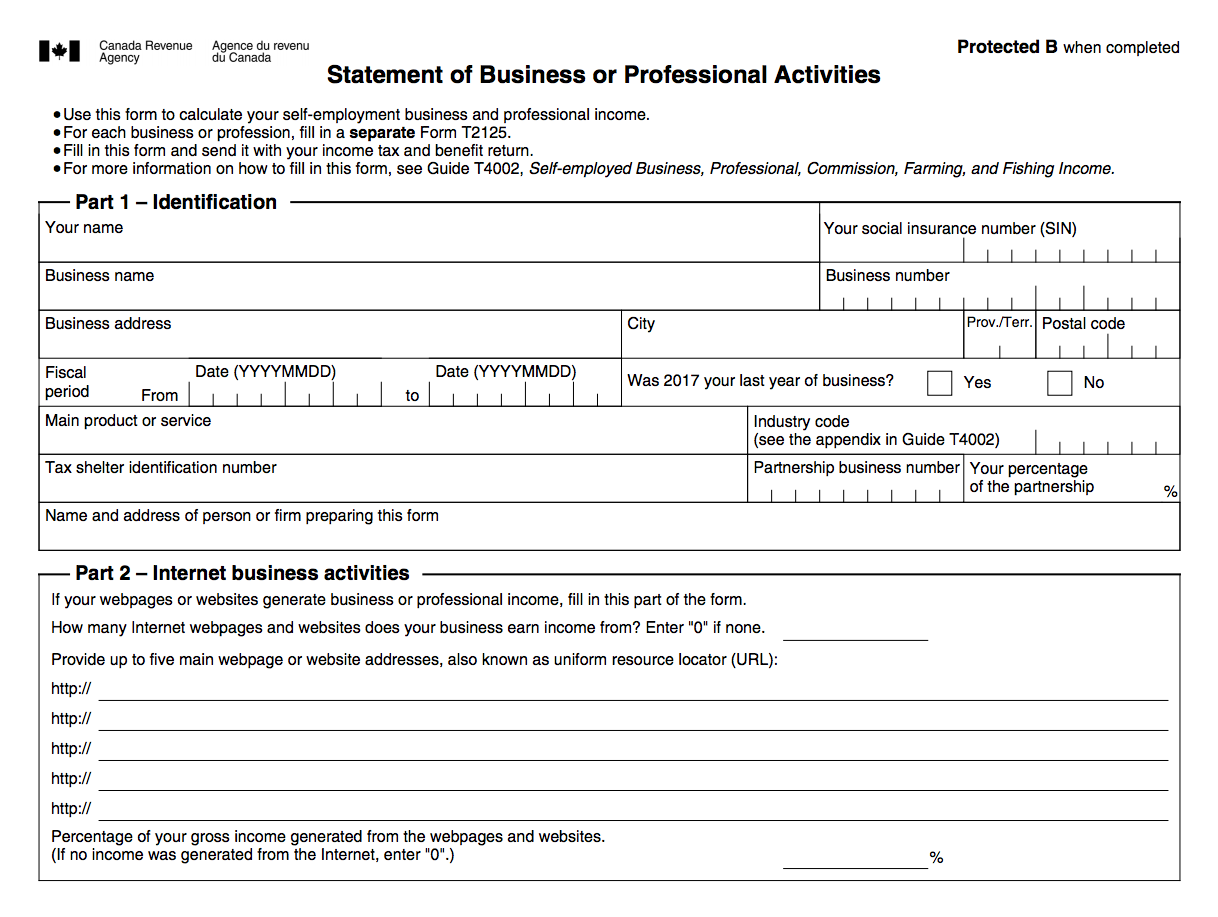

Cra Form T2125 Everything You Need To Know Bench Accounting

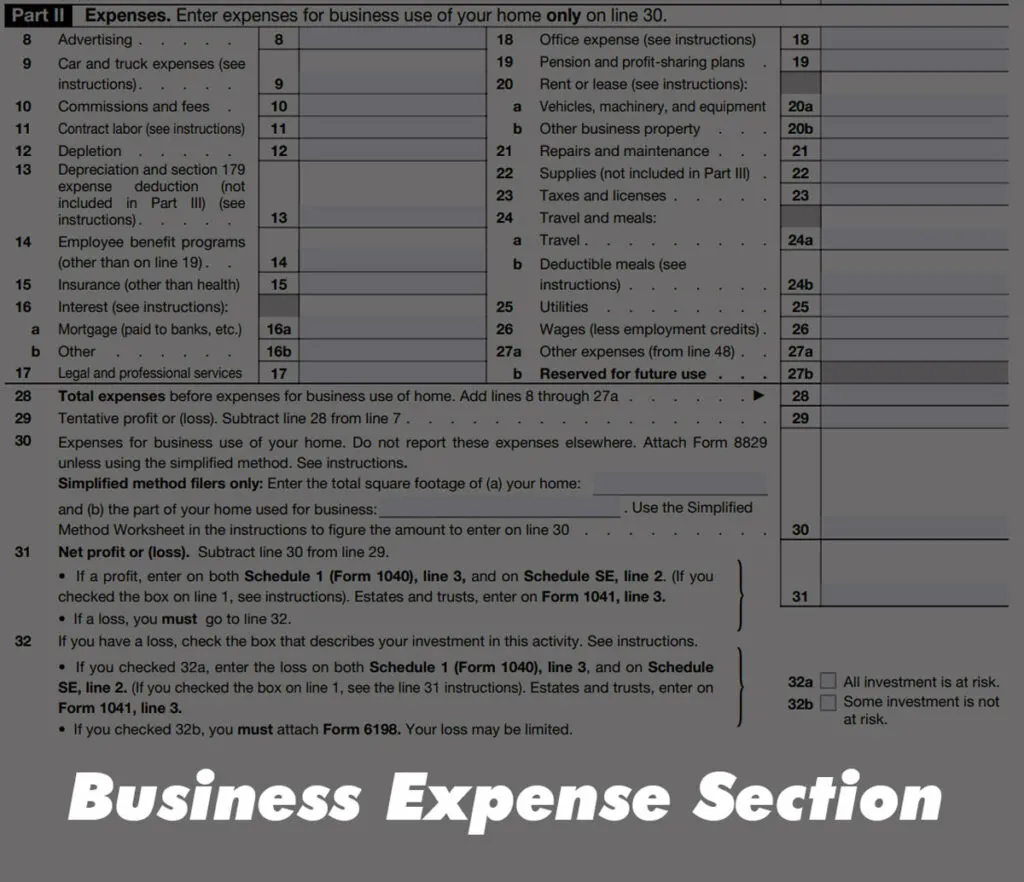

How To Fill Out Schedule C For Doordash Independent Contractors

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Business And Revenue Model Explained Infostride

How Can I Update My Restaurant Address

Doordash Driver Taxes 101 Dashers Guide Tfx

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Taxes Does Doordash Take Out Taxes How They Work

How To Fill Out The 1040 Schedule C Form For Gig Workers For Doordash Grubhub Etc For The Ppp Loan Youtube